Info

![]()

![]() How-to Start Trading on Stockmarket

How-to Start Trading on Stockmarket

(Click or Tap to expand)

-

What we offer: Learn how to trade with our trading algorithm indicators.

(NOTE: There is a a bulk discount of 15% OFF when purchasing 3 or more trading indicators at the same time!. Please Contact Us, before purchasing, and we’ll provide you with a nice quote!) - Why use algorithms: Price patterns often repeat themselves. With the help of a smart algorithm, these patterns can be used in our favor on gaining consistent profits by opening and closing trades at the right place and at the right time.

-

Why use our strategies:

- Majority of our indicators(unless it is a screener or an Options selling utility) cover every step of the trade, from open to close. There are no gray areas.

- There will be an alert with a label on chart for each step of the trade, providing a visual confirmation of the reasons behind each action.

- While you won't become a millionaire overnight, you will certainly learn how to trade responsibly.

-

While free TradingView account will be enough to trade with our Indicators (including alerts), a Premium account

is suggested (free account comes with limitations, for example: Deep Backtesting is unavailable under free account, while alerts expire every 2 months).

is suggested (free account comes with limitations, for example: Deep Backtesting is unavailable under free account, while alerts expire every 2 months).

Opening an account with a broker is a prerequisite to trade your preferred instrument, currency pair or a crypto coin. There are lots of brokers out there. When selecting a broker, the key objective is to ensure regulatory compliance and minimal fees, commissions, or spreads. A beneficial factor is their provision of a user-friendly app (desktop or mobile) for swift trade execution, a crucial advantage for intraday trading.

Regular US market session goes from 9:30am to 4pm US Central Time, this goes for stocks, indices, futures and so on. FOREX and Crypto market go around the clock (FOREX actually is closed over the weekend, opening on Sunday 5:00PM ET, closing on Friday 5:00PM ET). Some of our trading strategies include specific Trading Scheduling and some don't. Regardless, our indicators can be automated for any potential Trading Schedule.

Does not really matter. However, it's crucial to differentiate between profitable trading strategies (this is what we build) and the traditional approach to investing in stocks (this is where financial advisors assist). While technical trading strategies can involve both upward (LONG) and downward (SHORT) positions, stock investments typically align with the long-term growth prospects of a company. Trading strategies aim to capitalize on short to medium-term price movements, regardless of the market direction, leveraging both upward and downward trends. On the other hand, traditional stock investing is primarily based on the long-term success and growth of a company, with the expectation that the stock's value will increase over time.

One of the most critical elements in trading is managing risk. For any trading strategy, for consistent profits, it is essential to have:

- SL (Stop-Loss) or EOD(End of Day) Close [trade is closed at the end of the day right before market closes]. Our strategies will always include either one.

- Order size (each trade size) is not that significant as intraday strategies often involve larger trade sizes due to smaller price moves per trade, whereas swing strategies might have smaller trade sizes for more substantial price moves.

-

Initial sufficient capital to cover the Max Drawdown (greatest possible loss the strategy had compared to its highest profits), as indicated in the strategy's backtest data + capital to cover the margin (depends on the broker/account) or the strategy single Order Size (each trade size) if trading with cash account.

* While there's no guarantee that the Max Drawdown amount will be reached, exceeded, or result in an actual loss (as a strategy might potentially start with a losing streak), it's essential to be prepared for such scenarios and ensure there is enough capital to cover the calculated maximum drawdown amount from backtesting data. NOTE: If there is not enough capital to cover Max Drawdown, reduce the trade size. With consistent profits - trade size can be gradually increased.

EXAMPLE: For instance, if a strategy indicates a Net Profit of $20,000 and a Max Drawdown of $5,000 with an Order Size (each trade size) of 50 stocks, and there's insufficient capital to cover the $5,000 drawdown, consider reducing the risk. By decreasing the Order Size (each trade size) to 10 stocks, potential Net Profit may decrease to $4,000, but the potential Max Drawdown would also decrease to $1,000.

Cash Account: With a single order size of $250 and a strategy maximum drawdown of $1,000, it's optimal to start trading with a capital of $1,250.

NOTE: These figures are approximate and serve as examples, providing a reasonable estimate of the optimal capital for a chosen strategy.

-

How fast will I be granted access to the Indicator after payment?

In 24-48 hours (usually much faster) -

Can I use my phone for trading?

Absolutely, our trading indicators can be setup using the TradingView mobile app is possible. Regarding actual trading, most regulated brokers offer mobile trading options either through their website or dedicated app, which is the preferred method. This ensures convenient and efficient trading on the go. -

What if I miss a signal/alert?

There will always be another signal/alert, it is always best not to force-enter a trade, "A best trade is - no trade". However, even if a signal or an alert is missed, a custom alert can be created at the entry price of the missed signal. This allows wait for a potential opportunity. Given the typical zig-zag movement of market prices, there's a chance that the price might return to the entry point, enabling entering the trade or position. Even if the price initially moves against the trade, there can even be a potential to enter at a more advantageous point, as long as the trade remains active. This approach capitalizes on the dynamic nature of market trends. -

Are there days when it's best not to trade?

FOMC Meetings and big Holidays. While our algorithms primarily rely on technical analysis and don't factor in fundamentals, it's advisable to consider avoiding trading on days when the Federal Open Market Committee (FOMC) meetings occur. Market behavior during these periods can become irrational and yield unfavorable outcomes. However, it's important to note that all our backtesting is conducted without excluding FOMC days. Therefore, even if there's a negative impact on a specific day, the overall performance should not be significantly affected over the long term. During big holidays - there is simply no volume and almost no price movement. -

Is slippage (commission/spread/fees) accounted for in the algorithm Backtesting?

The level of slippage/commission depends on the specific indicator strategy configuration and the instrument being traded.

Here is what's used in our strategies for most realistic backtesting results:

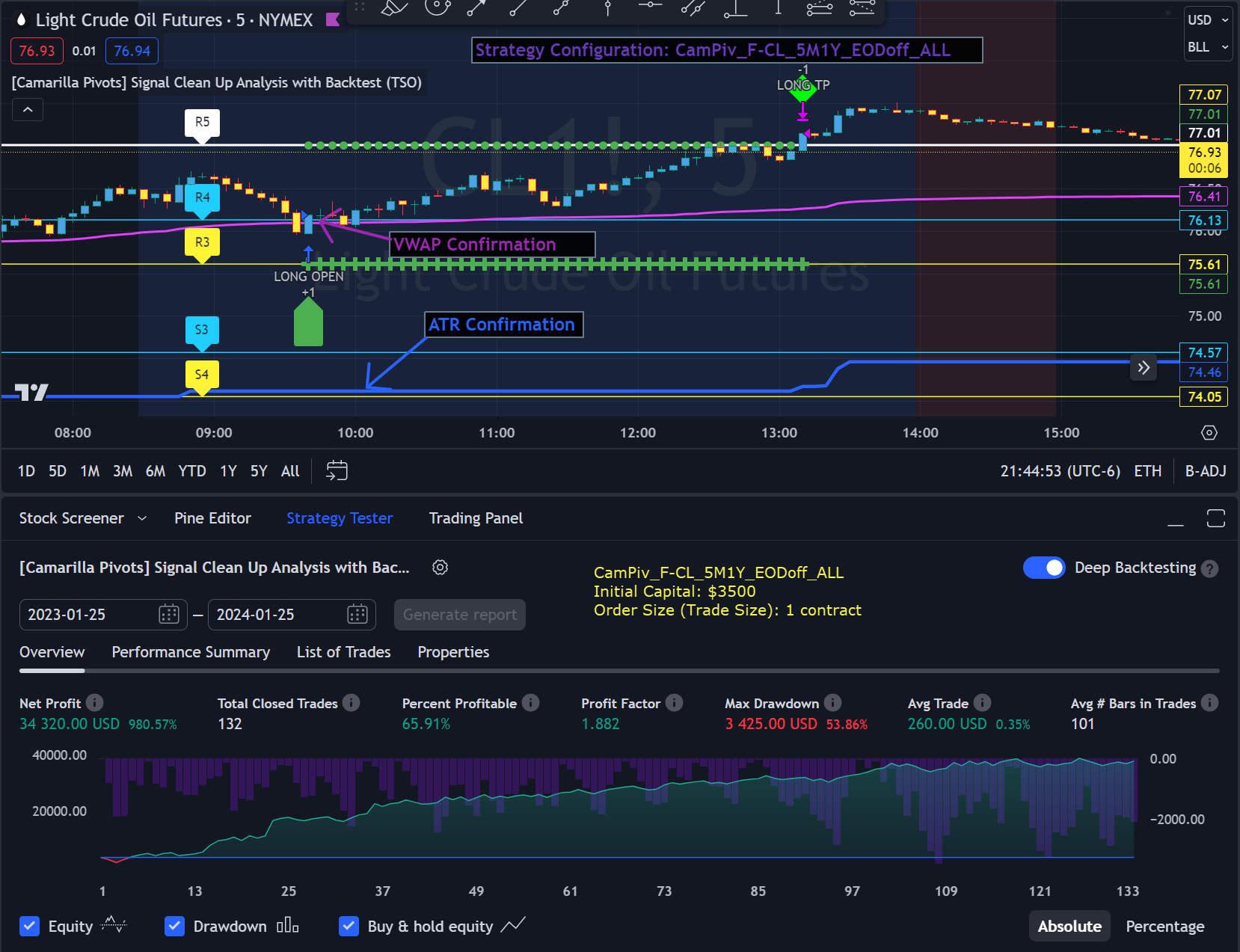

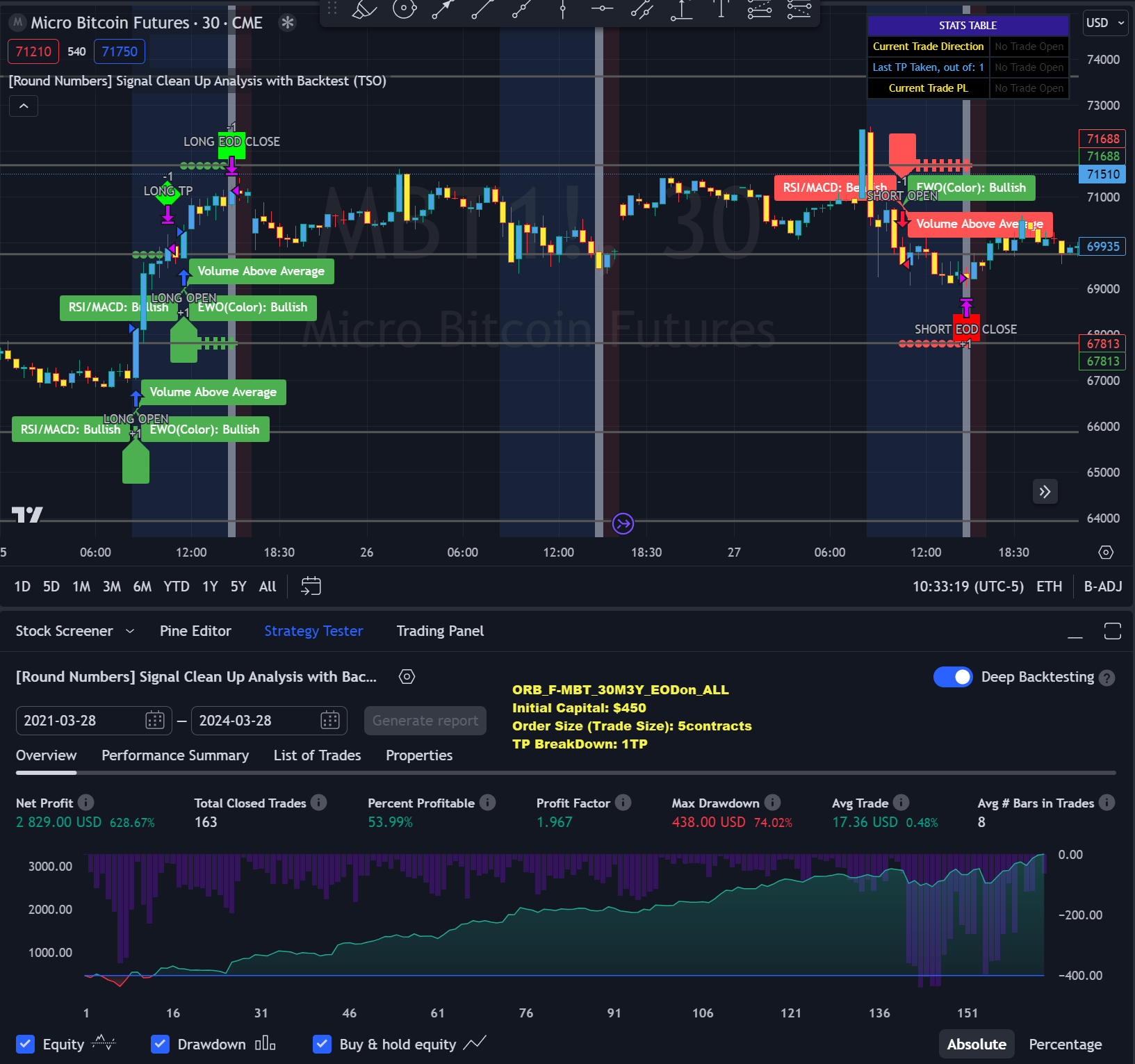

Instruments Trade Size Fees Crypto (BTCUSD) 1 contract (1BTC on margin) 0.1% commission per trade Futures

(Crypto, Indices, Commodities)

Broker examples: AMP, NinjaTrader1-5 contracts (depending on the # of TPs (Take Profit targets)) $2.50 per 1 contract (round turn basis[per whole trade])

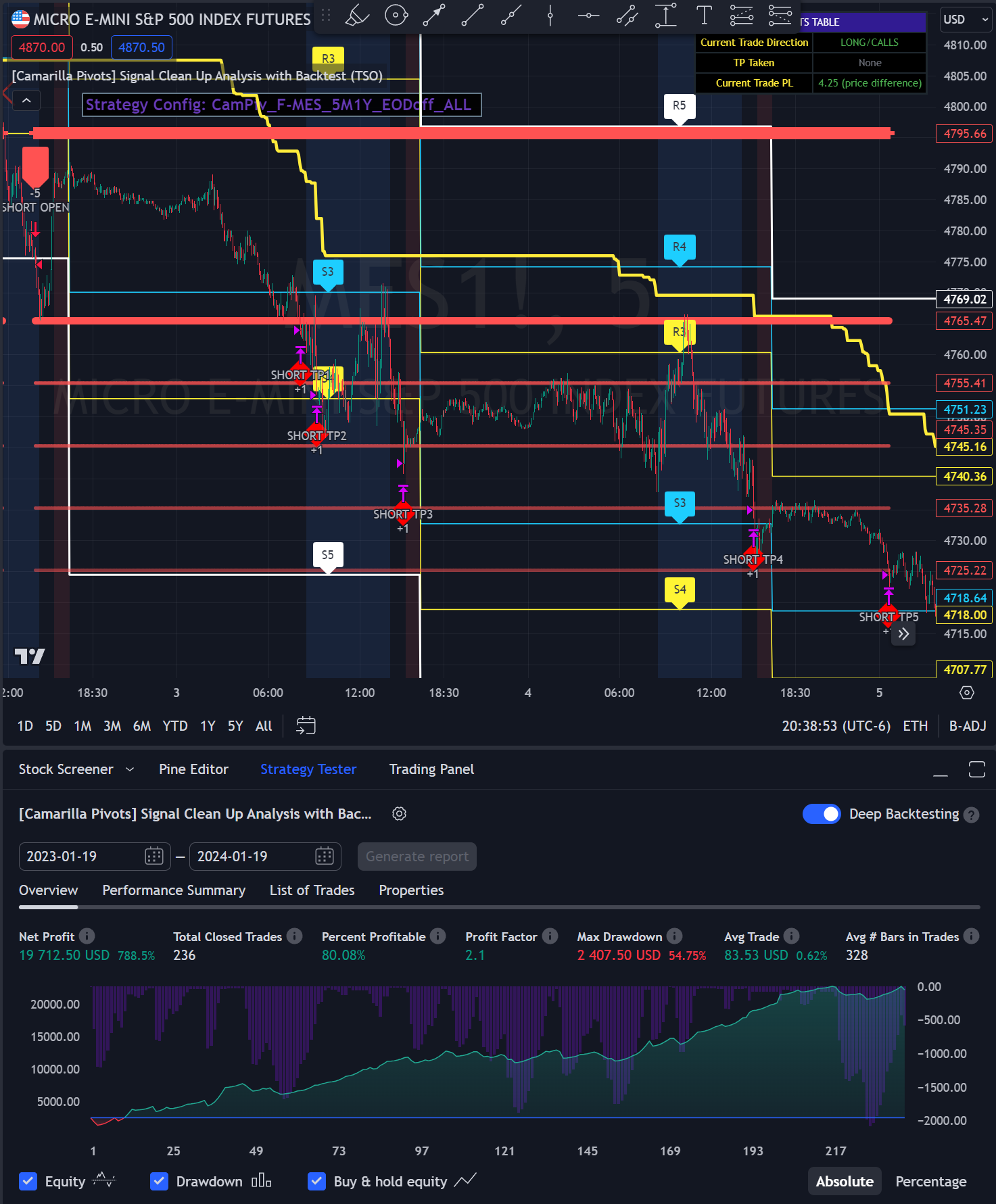

Micro Futures (MICRO S&P500(MES)/MICRO NASDAQ100(MNQ)/MICRO RUSSELL 2000(M2K)).

$5.00 per 1 contract (round turn basis[per whole trade])

Mini Futures (E-MINI S&P500(ES)/E-MINI NASDAQ100(NQ)/E-MINI RUSSELL 2000(RTY)/Light Crude Oil Futures(CL)/Gold Futures(GC)/MICRO BITCOIN(MBT)).FOREX (Currencies) 50,000 contracts (LOTS)

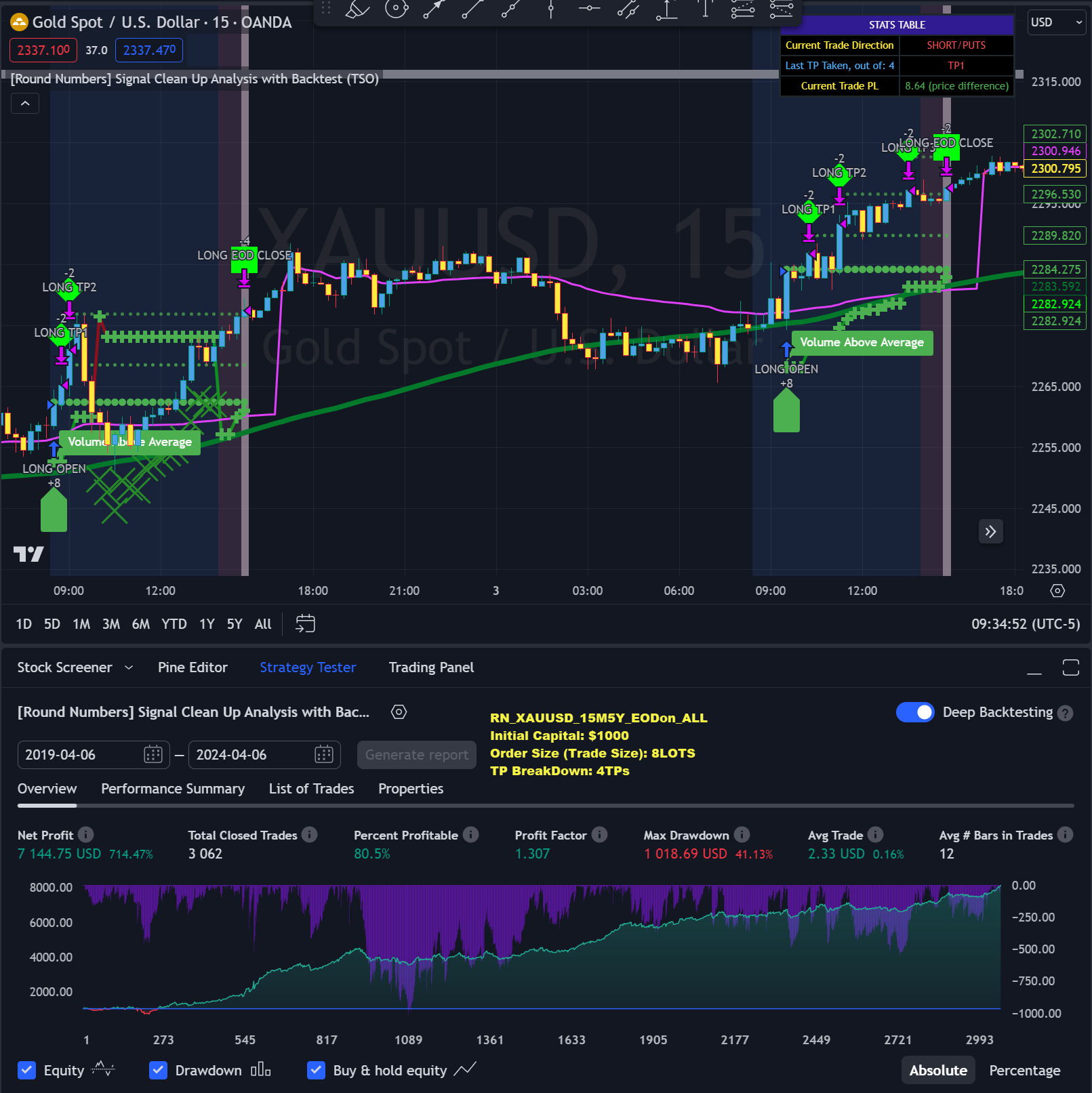

NOTE: 0.01 position size would be 1000 contracts (lots)18 (1.8PIPs spread) slippage

Each Broker has it's own spreads for various currencies, but 1.8 is the most average for regular currency pairs. For exotic currencies or something like XAUUSD (Gold) [average spread: 32] - we will use the exact spread from the Broker (we use OANDA for FOREX) and it will be included in the strategy configuration.Stocks

(Indices, Commodities, Stocks)50 contracts (shares) 4 slippage, $0.16 commission per trade

Showed the most realistic results between broker(Charles Schwab) and TradingView strategy tester.

TradingView

![]()

![]() Trading Indicators and Screeners

Trading Indicators and Screeners(Click or Tap to expand)

| Algorithm (click/tap to learn more) | Optimal Trading Style | Best Trading | |

|---|---|---|---|

| Trading Indicators | |||

| Auto Trend Lines | Intraday/Swing | Futures, Indices, Stocks, Commodities, Forex, Crypto | |

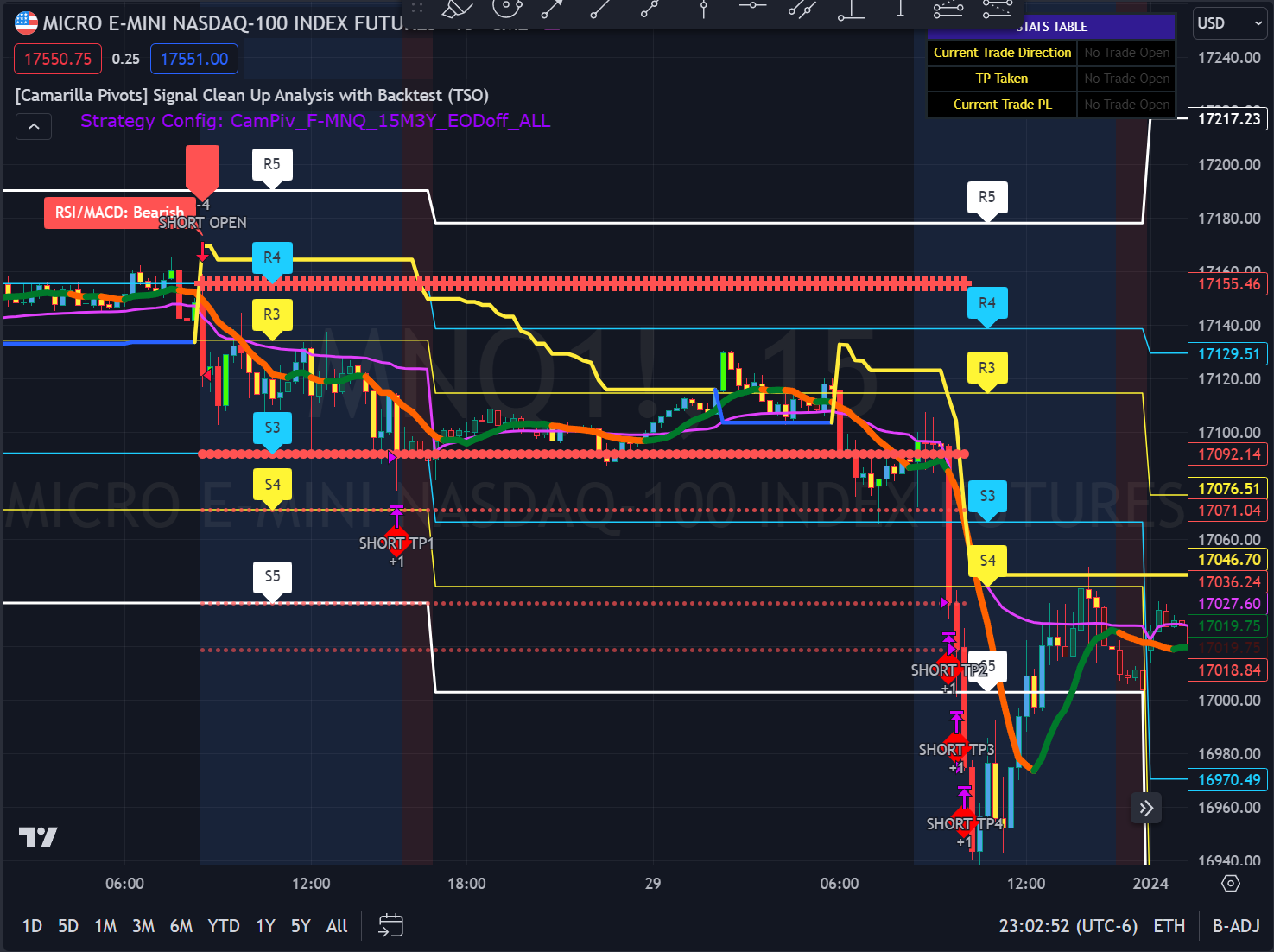

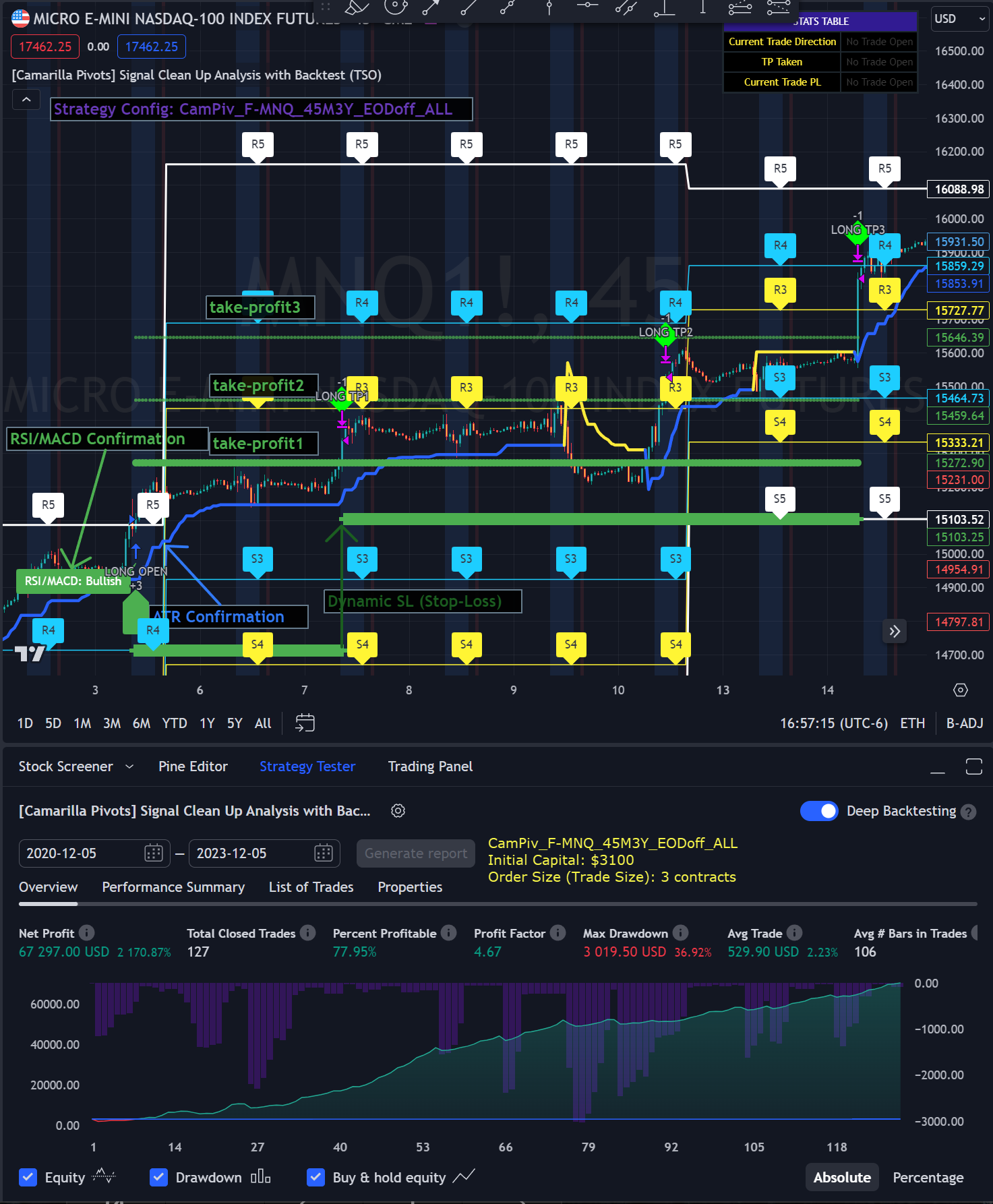

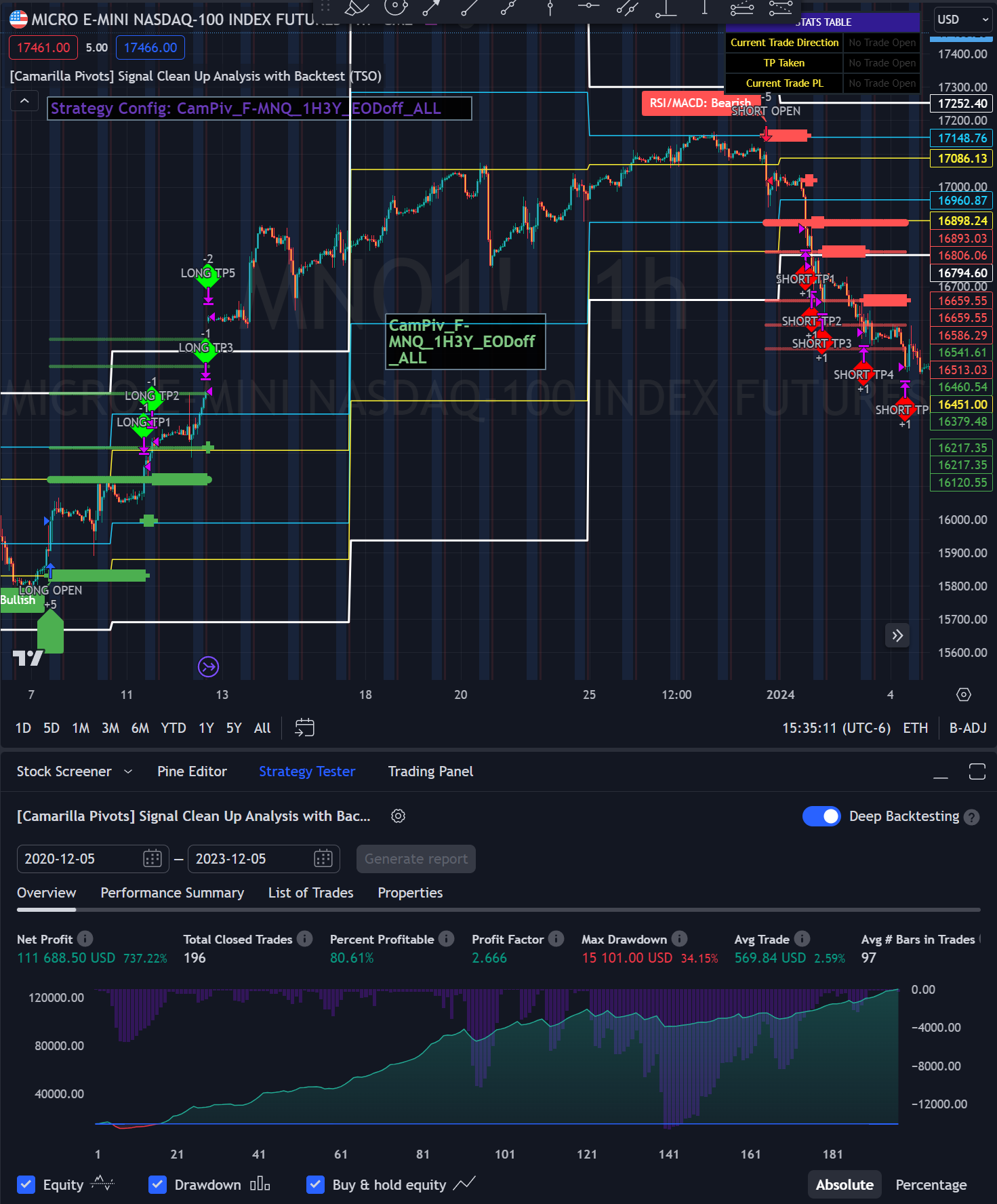

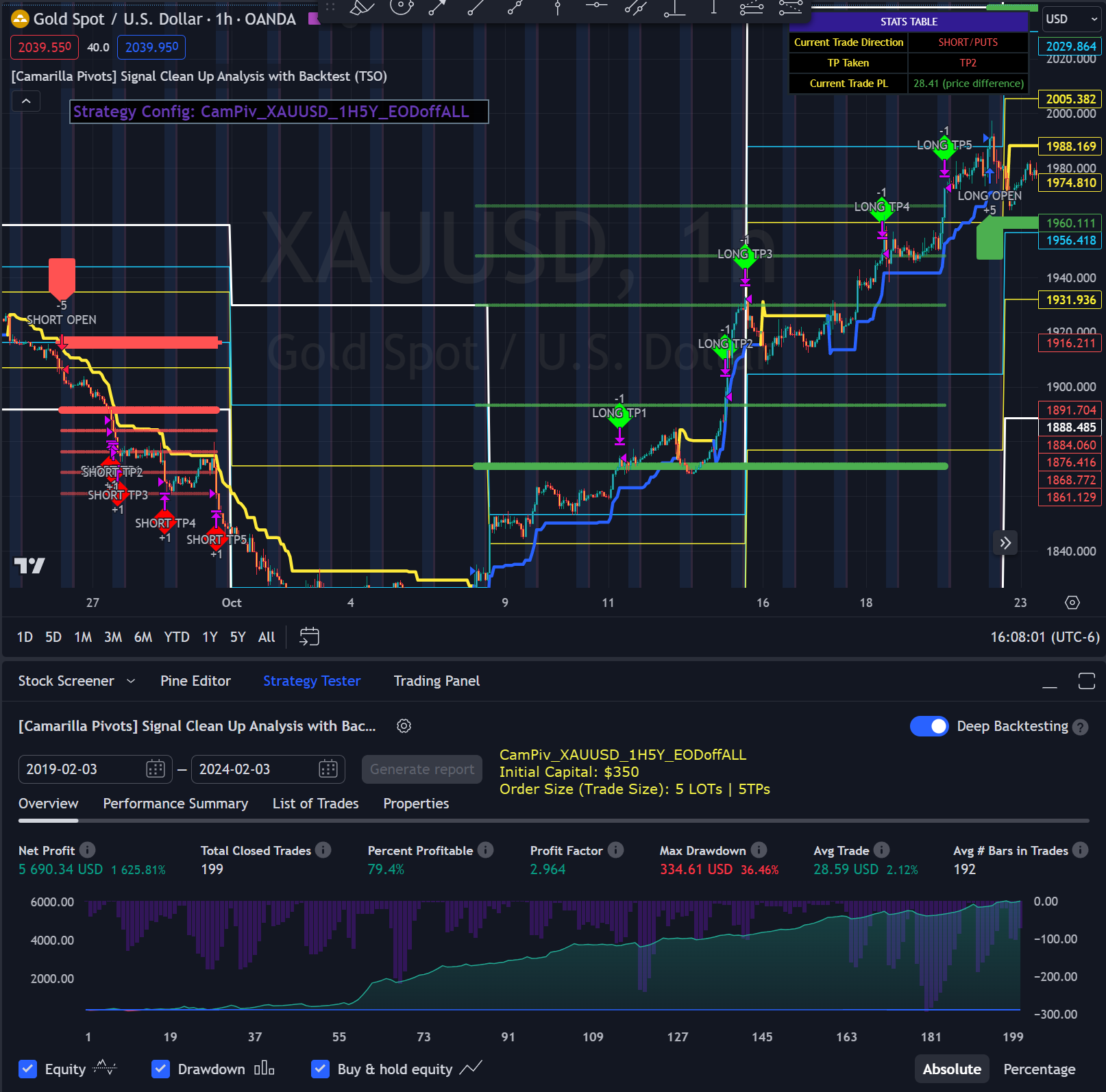

| Camarilla Pivots | Intraday/Swing | Futures, Indices, Stocks, Commodities, Forex, Crypto | |

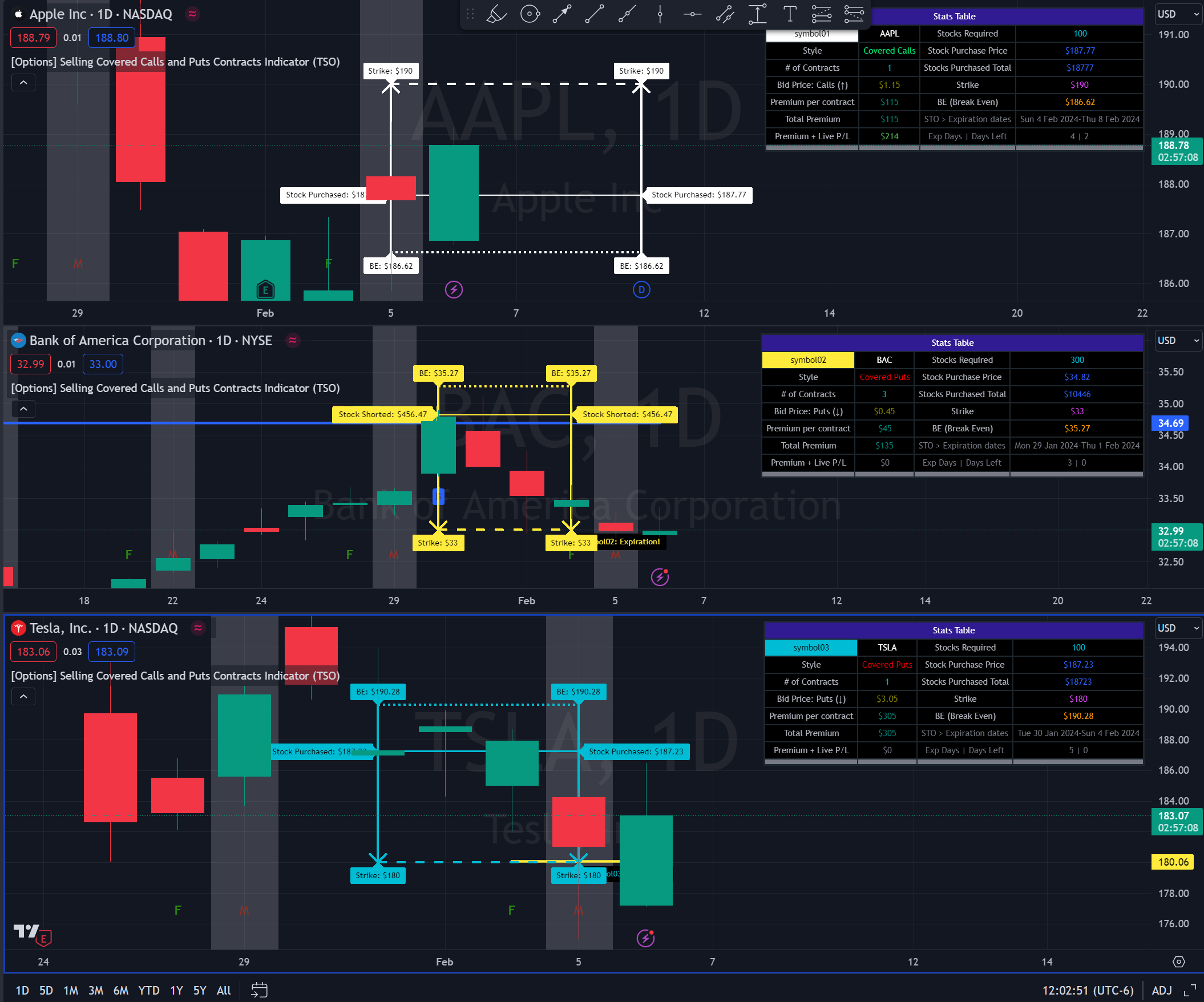

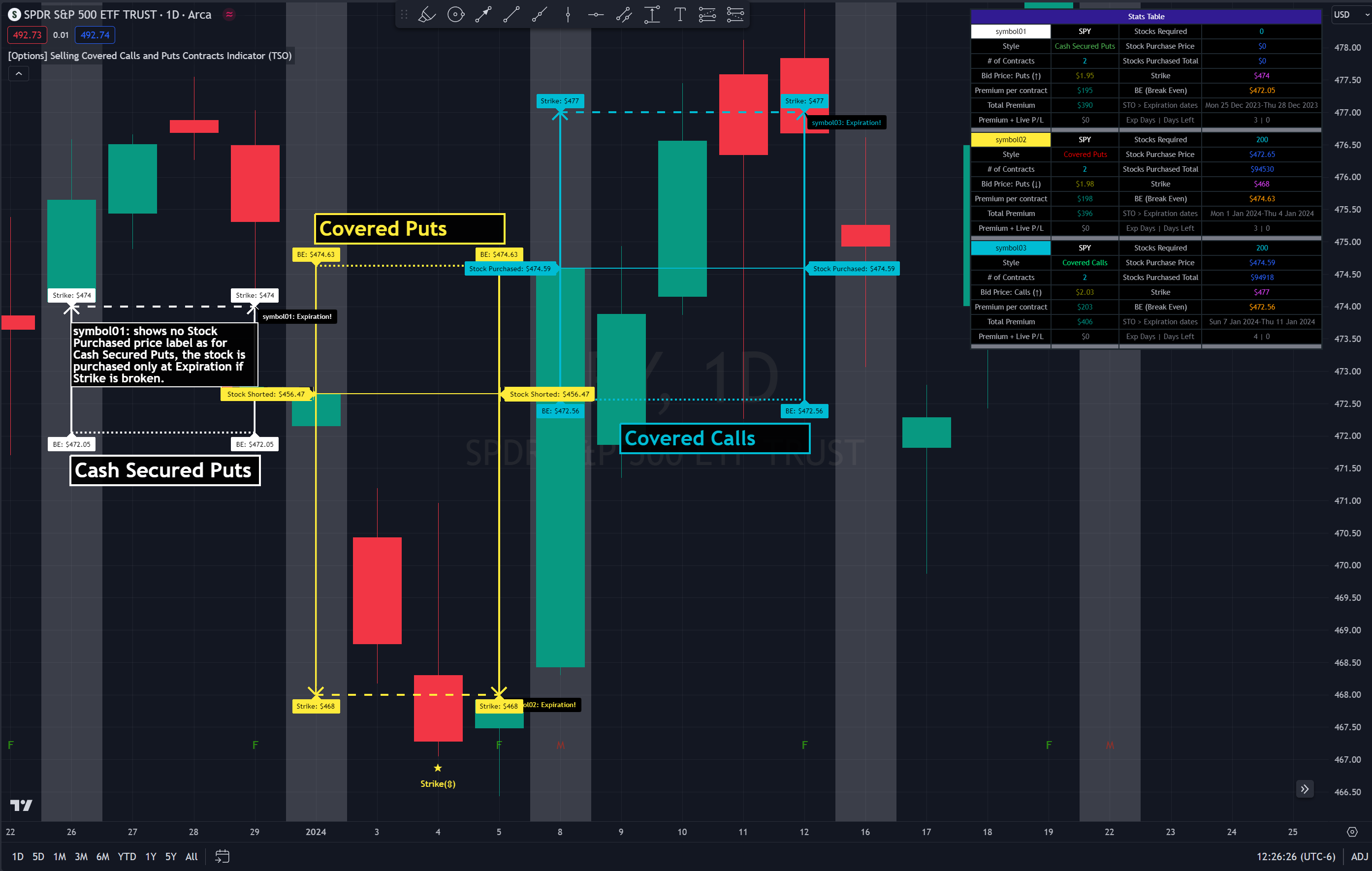

| Covered Options Visual System | Swing | Options | |

| Day Trading / Scalping with EMA Cloud | Intraday/Scalping/Swing | Futures, Indices, Stocks, Commodities, Forex, Crypto | |

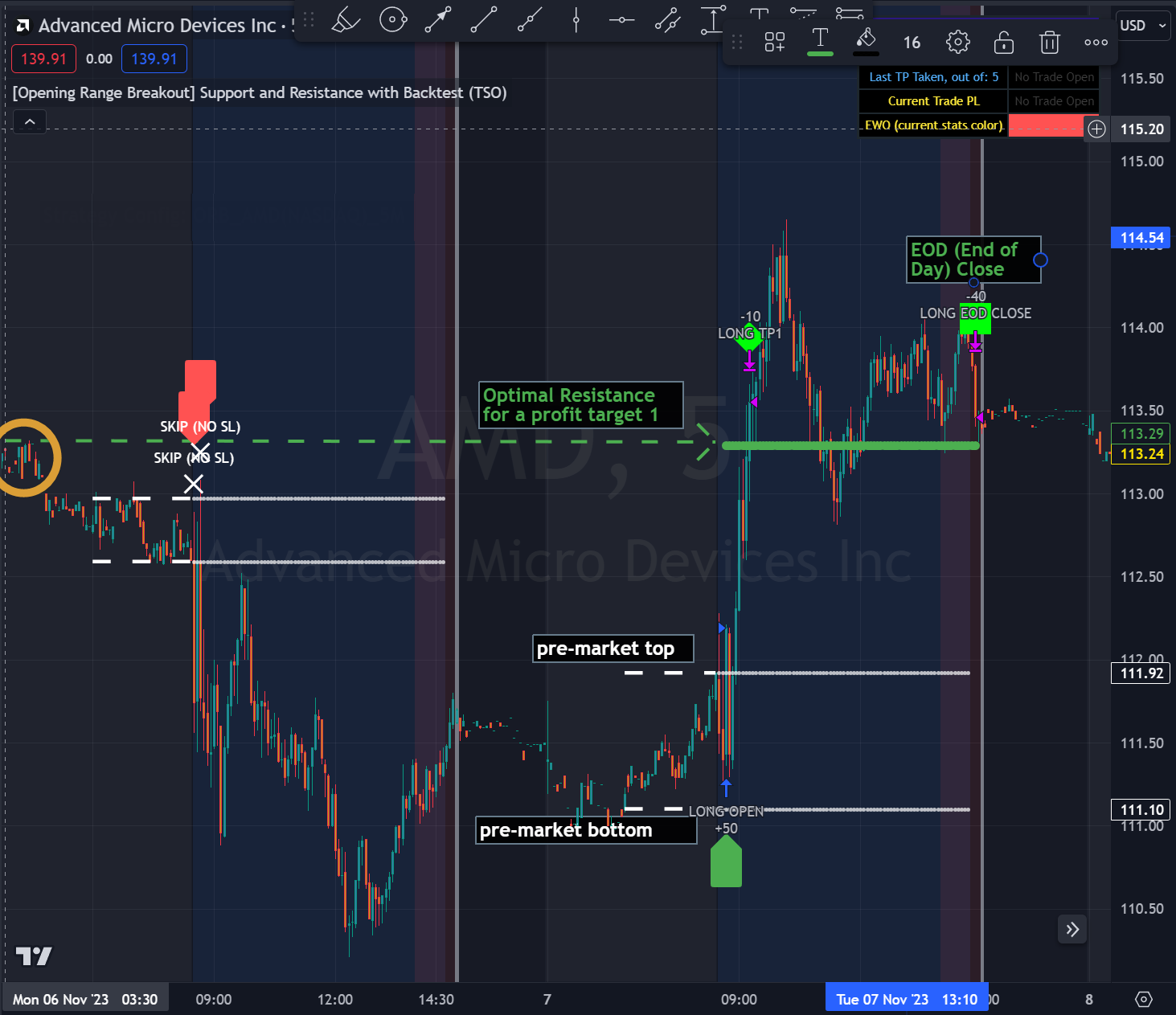

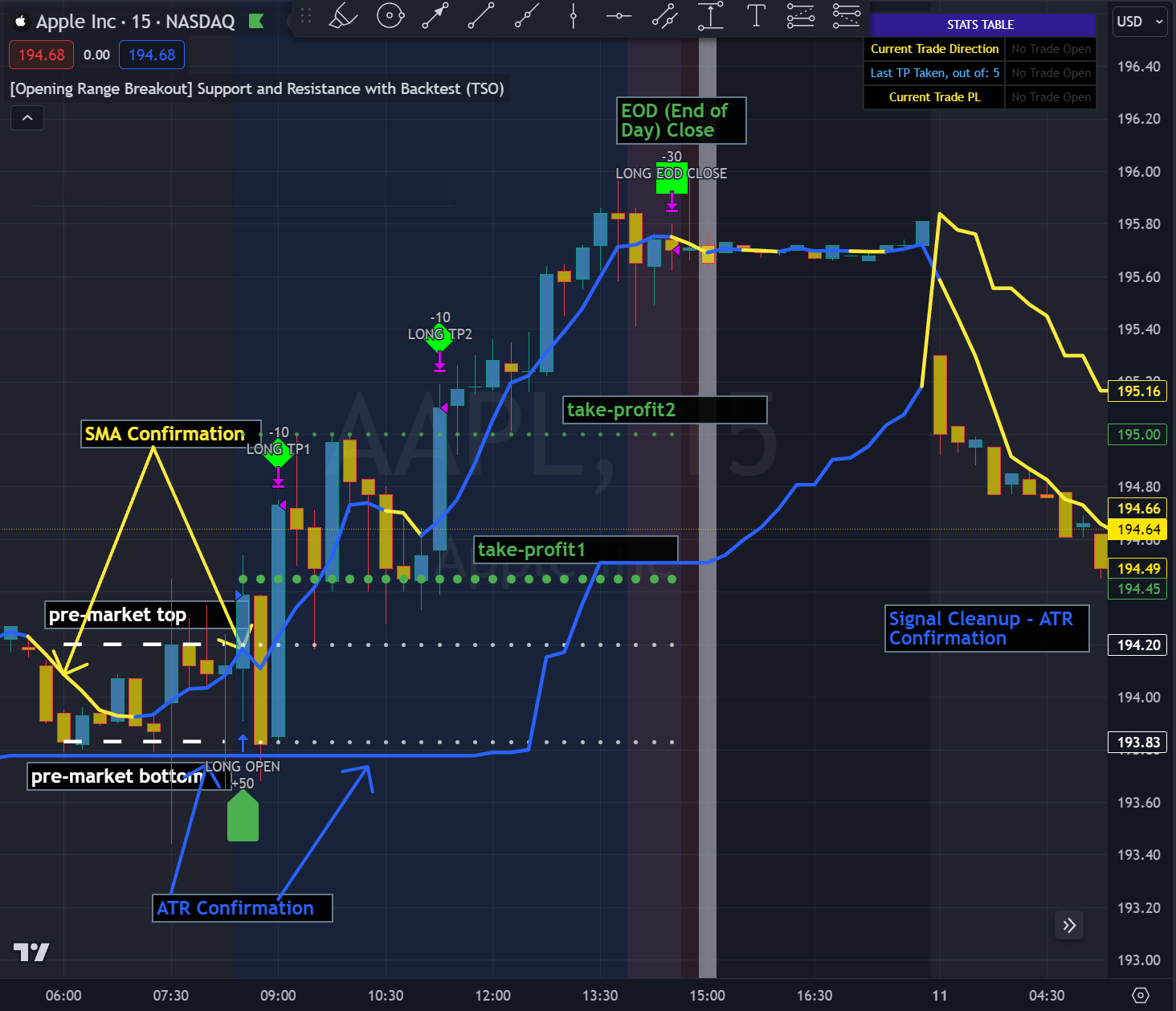

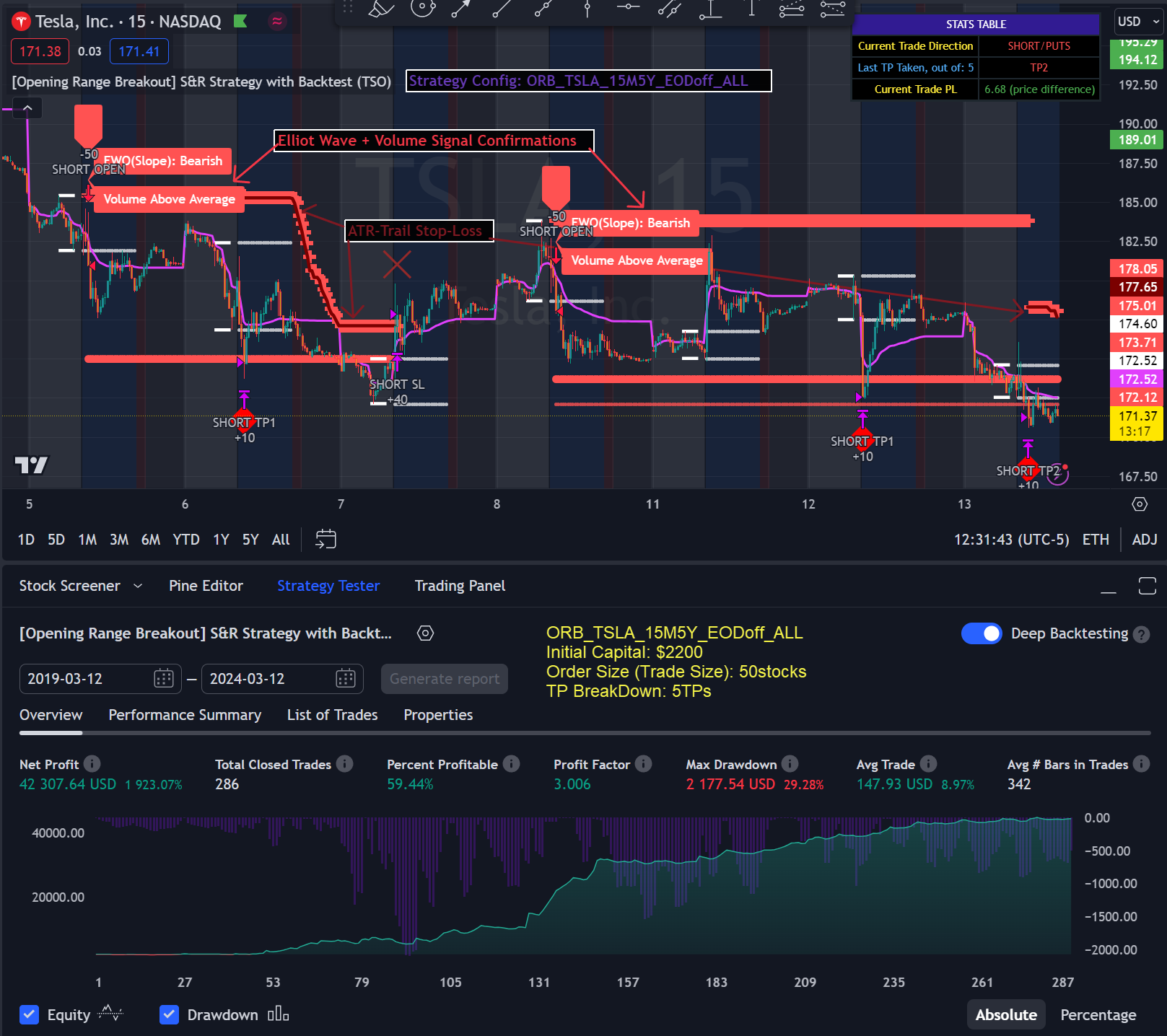

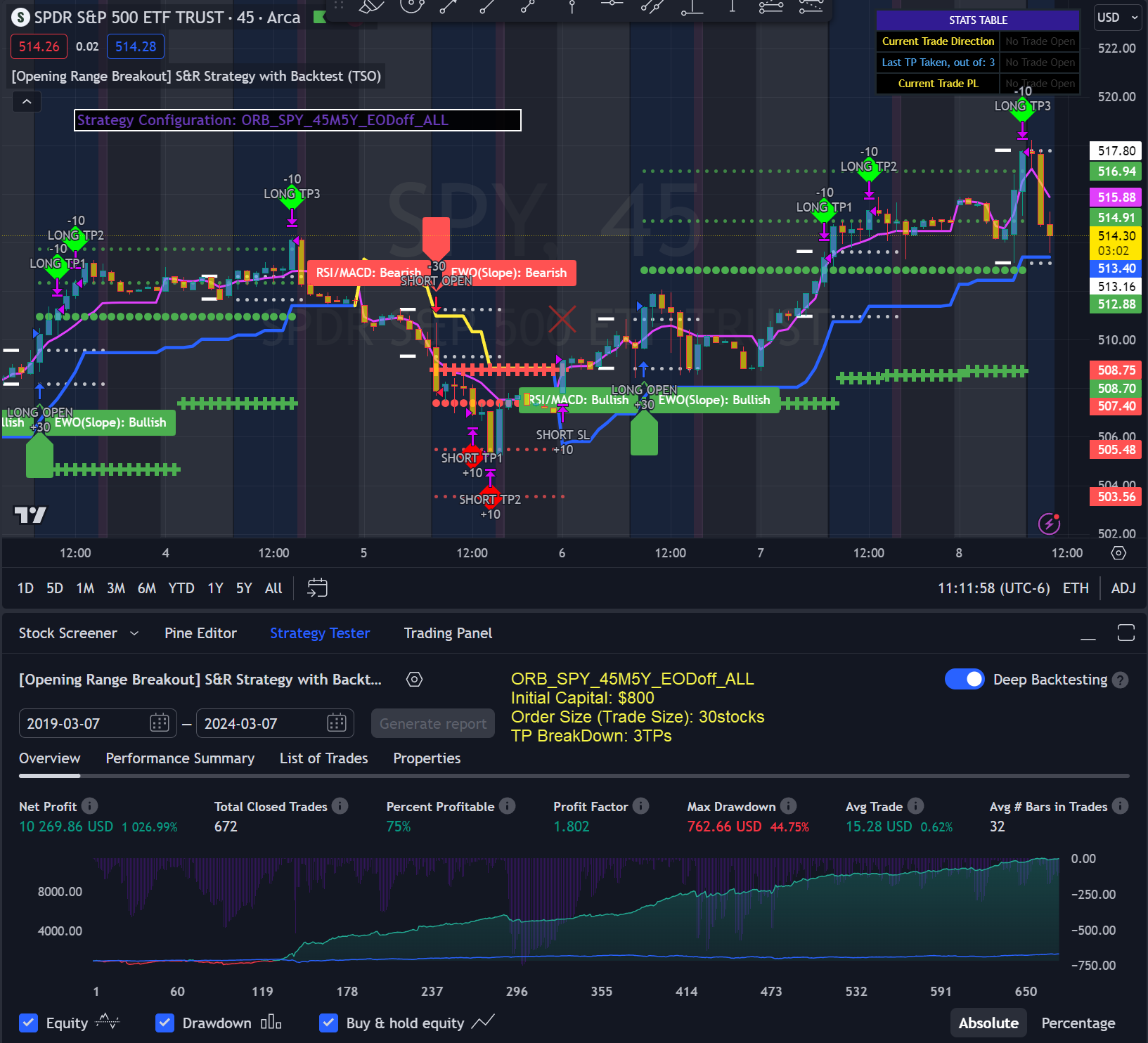

| Opening Range / Pre Market Breakout | Intraday | Futures, Indices, Stocks, Commodities | |

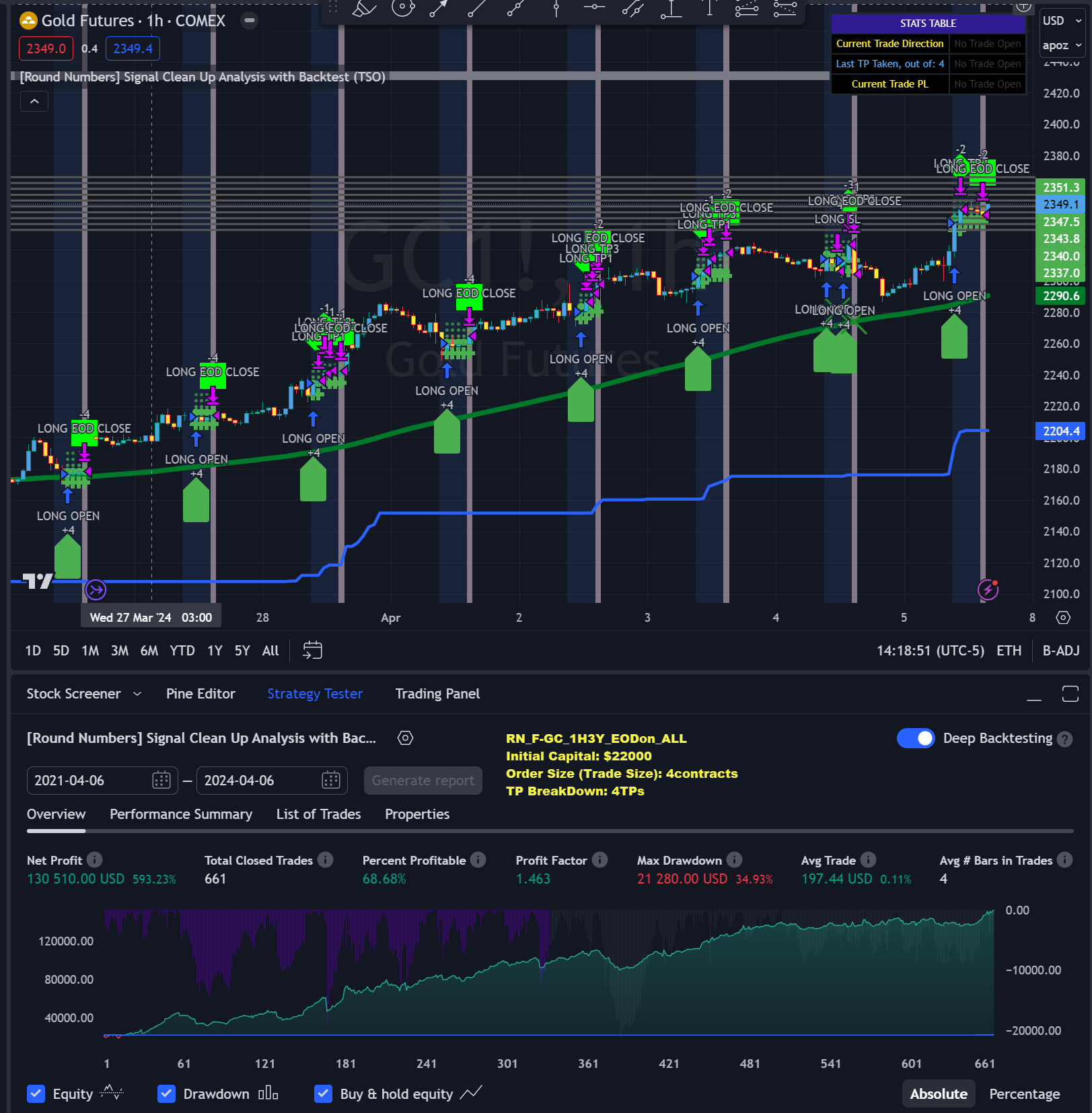

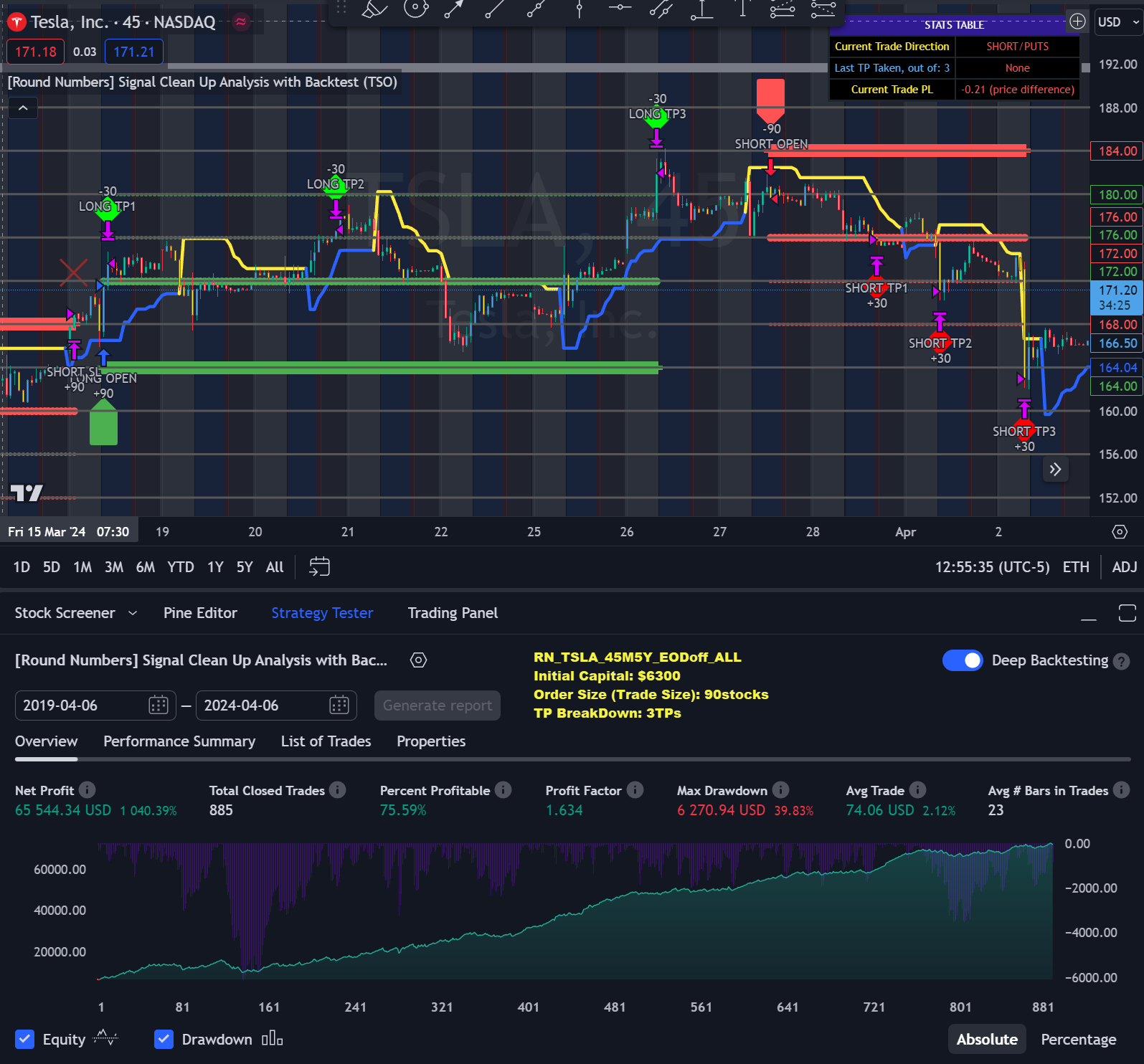

| Round Numbers Mathematical System | Intraday/Swing | Futures, Indices, Stocks, Commodities, Forex, Crypto | |

| SMA Cross w/ HHLL + Signal CleanUp | Any | Any | FREE! |

| Volume Profile + Signal CleanUp | Day Trading | Any | FREE! |

| Stock Screeners | |||

| Opening Range pre-Market Breakout Screener | Intraday | Futures, Indices, Stocks, Commodities | |

| Pivots Consolidation Breakout Stock Screener | Intraday/Swing | Futures, Indices, Stocks, Commodities | |

We also offer a bulk discount of 15% OFF when purchasing 3 or more trading indicators at the same time!. Please Contact Us, before purchasing, and we’ll provide you with a nice quote!

Here is how our indicators look and work.

_5M_BACKTEST_5YR-with-CHART.png)